In general, the Revolut card chapter is quite big, I would say, and it’s something I’m going to discuss in another article. In this one, I want to tell you about the card when traveling and generally using it abroad. This article is my own opinion. It was not written in collaboration with anyone and I am not being paid to write it. The link in this article is purely my promotion and falls under the “Invite Friends” reward program, where under certain conditions I can earn money for each person I invite without any financial burden.

It has been almost 5 years since I ordered my Revolut card. Although I didn’t use it to its full potential at first, I can say that for the past 3 years, it has been my main card for every trip. But before I go into detail, I want to go over a few things about the Revolut card and what it offers.

If you are one of those who have heard or even if you are a Revolut card holder then this article is not for you. But if you have never heard of it and how it works then keep reading this article.

What and who is Revolut card?

It’s a banking app and payment card that comes as an alternative to products designed to suit those with a global lifestyle or simply those looking for the flexibility they can’t get from regular banks. As Revolut itself states on its website, it has over 20 million people who have trusted it with their money.

What is a Revolut card and what can you do with it?

A Revolut card is just like a Visa card that you have bought from a bank. You can do exactly the same things you can do with it. Where all the “magic” happens with Revolut is in the app. You can manage everything from there.

- Get your bank statements first. Transfer money from your bank account to your Revolut account.

- Do foreign exchange in 30 different currencies with pretty good exchange rates and no hidden fees.

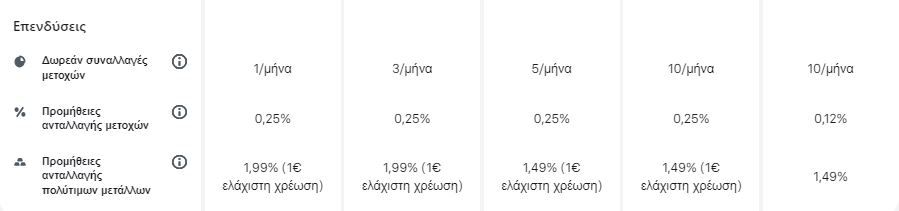

- If you’re interested, you can invest in stocks or even cryptocurrencies,

- There is also the option to create what Revolut calls safes and make your own savings in any way you like.

You can get your own card too and start using it in all your transactions by clicking this link here.

With Revolut on our travels.

It’s been a great help, especially with foreign currency. When you travel to countries outside the European Union, you always need to take foreign currency with you. In fact, on four occasions we have had to carry foreign currency, once on our family trip to Serbia, another time on a day trip to Ayvalik and Moschonisia, the third time in Budapest and twice in Poland, in Wroclaw and Warsaw.

Read also:

Ayvalik and Moschonisia: 6 Information & tips for your trip

In all four cases, I should say that I didn’t do any exchange from Greece or when I arrived there. All I had to do was go into the app and choose which currency I wanted to exchange the euros into. I now automatically had the currency I wanted in my account. Now all I had to do was go to a local bank ATM, insert my Revolut card, enter the PIN I had entered in the app as usual, and choose to withdraw cash without any further charges.

Read also:

5 things to do in Ayvalik – One day trip from Lesvos

Apart from the amount of the exchange rate when I made the change from Euro, I was not charged any other fee. So simple and easy. With the Revolut card you can do exactly what you do with any other card.

From going to an ATM and withdrawing cash to making purchases in any store that has a POS terminal without any charges.

And the commissions I have seen on trips where we needed a currency other than the Euro have often been lower than a well-known foreign exchange company.

Revolut: One card, infinite options.

I won’t sit down in this article to go into more of the possibilities you have in terms of cryptocurrencies for example. If you are interested in some more analysis with what options you have through the Revolut app, leave a comment and we will compile them into a new article.

In general, Revolut is really a card that has solved my hands in terms of getting the foreign exchange we need instantly and without the crazy fees we used to encounter in the past when we went to physical stores to make foreign exchange.

The possibilities you have with the app and the fact that it is accepted as a card in every transaction we do, makes it a must-have card.

What are the benefits of Revolut?

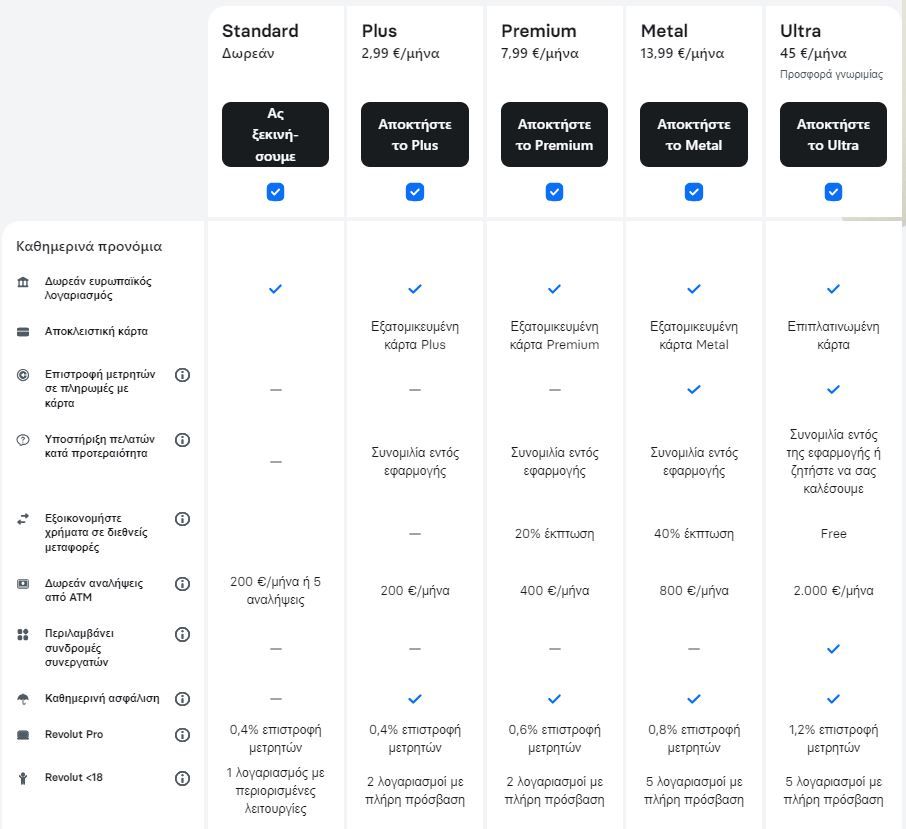

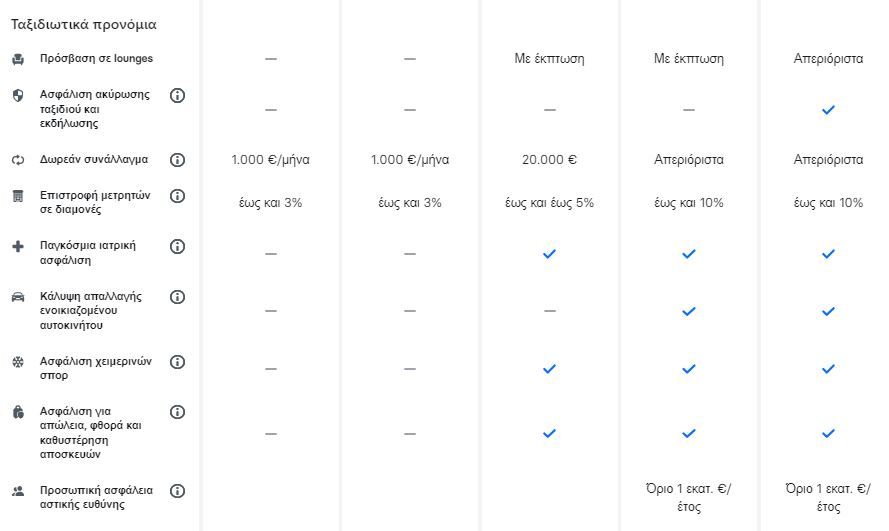

You have five options in terms of the plan you choose, each with different benefits in terms of daily withdrawal limits, discounts on international transfers and many travel benefits. Depending on your needs and usage, the options are considerable. Of course, only the Standard Plan is free. The other four have a monthly fee that starts at €2.99 and goes up to €45 (Prices in Greece).

The standard plan covers me personally for the use I make of it, and I haven’t gone through the subscription process.

- Revolut Standard

Revolut’s unique no-fee plan, where the only cost you incur is the issuance of the physical card.

- Revolut Plus

For €2.99 per month you get almost the same benefits as the standard plan with just a few more perks. The only difference at first glance is the ability to create two Revolut < 18 accounts with full access. This is great for parents who have two kids and want to give them a card with lots of features.

- Revolut Premium

This plan is priced at €7.99 and offers you discounts on international money transfers, an increased monthly withdrawal limit (€400/month), free foreign exchange up to €20,000 compared to €1,000/month with the previous plans, and much more.

- Revolut Metal

For €13.99/month, you get your own metal card (unnecessary), unlimited foreign exchange refunds from stays, worldwide medical insurance, winter sports insurance, lost, damaged and delayed baggage insurance, €800 per month in free ATM withdrawals, and much more.

- Revolut Ultra

In this package, which is of course the most expensive with a monthly subscription of €45 (introductory offer), you get a lot of great benefits. But this is where a lot of questions come in about how much this really benefits you and how much it’s worth paying €540 a year. As you can see from the pictures and the Revolut website, there are a lot of positives in terms of the travel benefits this card offers you. But there are still conditions to having such a program.

Accommodation and activities.

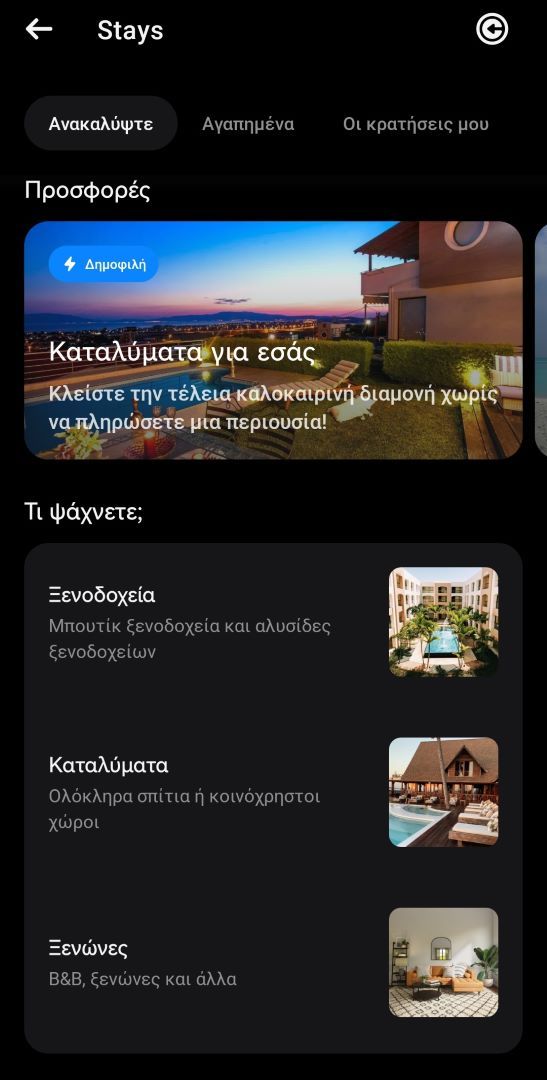

Something new that has made its appearance through the Revolut app is the possibility we have in terms of travel. Through the app, we can book our accommodation in hotels, hostels and lodgings and instantly earn up to 10% cash back.

In this link you can read about Lesvos Island and the top 13 things you have to see in this beautiful Greek Island.

In addition to accommodation, we can also book activities such as guided museum tours, organized day trips, cycling tours, walking tours, food tours and generally anything you can think of, with immediate reimbursement.

You can read also:

Moschonisia: A jewel on the coast of Turkey

Final conclusions for a Revolut card.

In general, from my personal experience over the last five years of using it, I can say that I have been completely satisfied with even the simplest program. But that said, which program you choose is relative and has to do with the use you make of the card. From withdrawals, deposits, money transfers, foreign exchange, and even cryptocurrencies.

Anyone who has asked me about Revolut, whether it is worth getting a Revolut card, my answer is “yes”. Friends and acquaintances ask me which is the safer way to get foreign currency on a trip where there are no euros. My answer is always the same. Revolut and Revolut again!

You’ll get the best exchange rates and no extra fees. You can also withdraw cash in the currency of the country you’re visiting from any ATM, again free of charge, up to €200 per month with the Standard and Plus plans.

So yes, if you want a card that does all that and more, then Revolut should be the card that covers all.

Find us on social media

Follow travelshare.gr on Google News and be the first to know about our trips, excursions, suggestions and tips for each destination. Follow us on Facebook, Instagram, Youtube, Tiktok & LinkedIn.